This month of August 2021 marked the 50th anniversary of Pres. Nixon closing the "Gold Window".

Meaning, the U.S. Corp. no longer would redeem the Federal Reserve Notes in gold to anyone

including sovereign nations (who held billions of FRN currency). While the incorrectly named

"dollar" would still be the "world reserve currency", all others floated against it. Since then,

every time the dollar would go up, all others would go down - and vice versa.

Also afterwards, inflation rates followed as did stagflation in the 1970's. Without gold as an

anchor for monetary policy, it gave the central banksters power to print their FRNs infinitum,

which means more public and private debt, higher inflation, and more severe financial crises.

And NO - the illegal / unconstitutional U.S. Corp. governance, acting as the bonafied government

for these unites States of America, will not stop it as they are allowing it, caring not if it

places the debt upon the taxpaying citizens. So what?!?!

You must understand that the stock market loves this loose monetary policy as the next day

after Pres. Nixon gave his speech, the markets rose by 3%. Since then, they have been addicted.

Also, you must understand that the gold standard was replaced by the US dollar standard,

backed by oil and that's why we call it - the Petro Dollar. Now, all countries conduct similarly

unsound monetary and fiscal policies (and some central banks like the ECB or BoJ are even more radical than the Fed).

To make matters worse, central banksters around the world have "monetized their debt",

which we call derviatives, to the tune of untold and unknown TRILLIONS.

You may be asking, So Mr. Smarty Pants - why isn't gold higher? Well ... it is 4,100% higher

since 1971, which is 7.7% growth annually, and yes it should be much higher than the

Chart shown below.

From the Central Bank: "The Federal Reserve Bank of Kansas City's Economic Policy Symposium in

Jackson Hole, Wyo., is one of the longest-standing central banking conferences

in the world. The event brings together economists, financial market participants,

academics, U.S. government representatives and news media to discuss

long-term policy issues of mutual concern."

Now let me sum it up! The self-ascribed global elite (ie, Rich Men of the Earth) Luciferian

Cabal are sending some minions to dictate pablum to ONLY a certain hand-picked

audience - including of the Socialist Press Club, so they will spew forth more propaganda

to the people and the Cabal's plans can further carry out their goals of robbing you of your

purchasing power, taking over more corporations, manipulation of their fiat currency

supply which allows them to continue and rule the world.

It's a game they've been playing since the beginning of our once great republic, but

for which now is termed a "democracy" ... as in demi-gods and demogogery.

Nevertheless, why should we care what those mutants come up with? Because as

members of a private bank (the Federal Reserve Corp. is no more federal than Federal Express)

whom no one has elected, but whom actually control monetary policy.

What can we expect from this special meeting of "special" people? And what will it

mean for the U.S. and global economy? Well, I'm looking at recent reverse purchases

by the FED (as in federal reserve corp.) which recently almost hit $1 TRILLION. See graph

below. (right clik - show image to enlarge)

The going logic / spin, is that "when the Fed purchases assets, it injects liquidity

into the markets." On the contrary, when the US central bank engages in reverse

repurchase operations, it drains liquidity from the markets. This is because reverse

repurchase agreements are purchases of securities with the agreement to sell

them at a higher price at a specific future date. I'm refering here to buying

and selling from the point of view of financial institutions. They are purchasing

assets from the FED to resell them later, so they basically lend some money to the

US central bank. To me, it seems they are purchasing some stocks from the FED,

while placing Put Options (right to sell at a higher price) allowing them to profit

handsomely at some time in the near future when the markets crash!

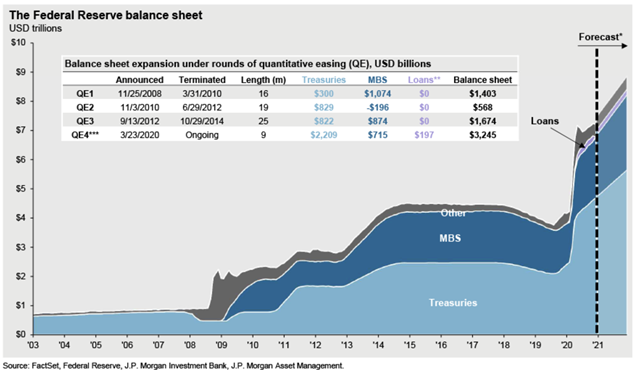

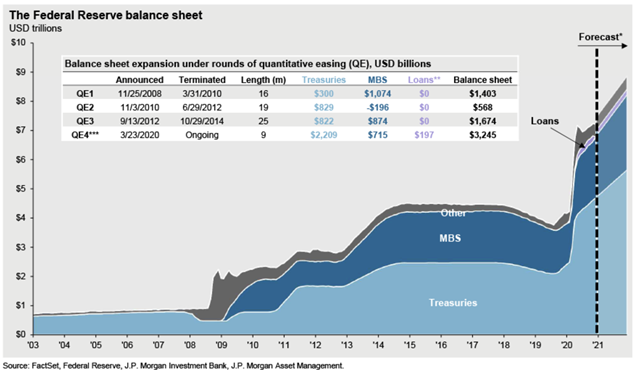

In case you didn't know, the FED Corp. buys about $120 billion per month in

Treasuries and Mortgage Backed Securities (MBS). BTW - a MBS is simply your mortgage

turned into a security and traded on Wall Street. Which means your mortgage was

split from the Note, which is illegal and supported via 130 years case law

under Supreme Court decision.

I digress. Point being, this is an attempt by the Central Bank (FED) to normalize its

monetary policy and regain control over interest rates. Remember what happened

in 2019? The Fed's tightening cycle practically always ends up in a recession. However,

this time a major problem exists for the FED. See chart below.

Such a giant balance sheet creates downward pressure on the interest rates.

If left alone, they could even drop below zero.

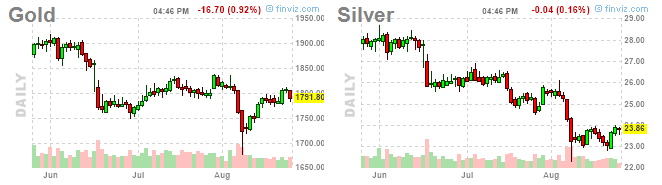

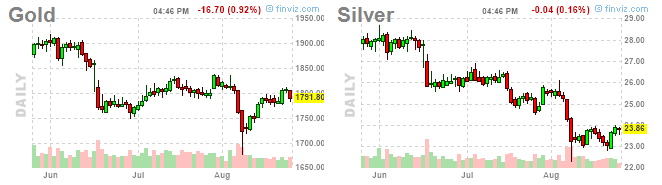

This is also a a strong signal that the Fed is preparing to raise interest rates. This will

hurt the economy, but will be good for precious metals. In fact, I believe investors in

precious metals are already getting the hint. See chart below.

Gold and Silver, as well as Platinum, Palladium and Copper have bottomed and turned north

recently. Not a few days does a trade make, but my signals show this is a major turnaround

for precious metals. Credit markets point to the risk-on moves to continue, favoring

the reflation trades as yields and inflation expectations will surely pick up.

As for the stock markets!?!? The FED "taper" tough talks have rocked the boat, to say the least.

But as stated above ... its just a matter of time before the TOP is in and the rats run scared

as the chicken screams - "the sky is falling"!

The bottom line is this...markets love free money and low rates. This central bank

has given them both for the last 12 years and we're addicted. We are the ultimate

"Junkies" where we need ever larger shots of juice to produce the same economic

high. Just the idea of them removing some of the punch from the bowl often sends

the market into a hissy fit. Lately the talking heads on TV (spewing propaganda like

it was Nazi Germany) are saying the tapering is good. Read - tossing both sides a bone,

while keeping people off balance. They say, "the economy is strong enough to

withstand coming off the "emergency" accomodative policy". REALLY !?!?!?

If 80 billion a month in Treasury buying and another 40 billion a month in Mortgaged

backed securities, along with sub 2% interest rates... was responsible for getting the

market to the level's it is at, am I to believe that removing some of that buying and

letting rates begin to inch higher won't affect things?

Come on man! When you buy billions in Corporate debt, you become a defacto owner

of some portion of that company. Can you say take over boys and girls? That in my

book spells FACISM falling into COMMUNISM when corporations are controlled by

the state. And what do you think will happen, when again, some corporations

will not be able to cover their bets via the gargantuan deriviatives markets?

Just saying !!!

Wake Up and Smell the Stench.

At some point the masses must wake-up and demand, whom the bible refers to as the "Rich Men

of the Earth" be brought to justice for their crimes against nature and mankind.

The final reckoning is now upon us all. Mankind has to make a choice, as relying on

government always results in failure.

CHANGE IS COMING ... BELIEVE IT ! ! !

BE A PART OF IT - VISIT National Liberty Alliance,

take the Free Constitution Course, the Civics Course, and get involved to take back our Republic.