Are we in another Bubble? Absolutely! When will it Blow-up? Ah! That's the Billion dollar question.

But the right question none the less. With Commie/Socialist (is there any difference?) policies now

in place by the far left (commie infiltrated

Socialist Democrat Party) who have stolen the U.S. Presidential

Election, it is all but assured. We are witnessing polices that encourage aggressors and enemies

which is causing decline in the U.S. economy. And Yes, that means your pocketbook. Loss of jobs,

higher taxes, fat-cat bureaucrats getting richer is already

happening on a grand scale as they usher in the Luciferian Globalist N.W.O.

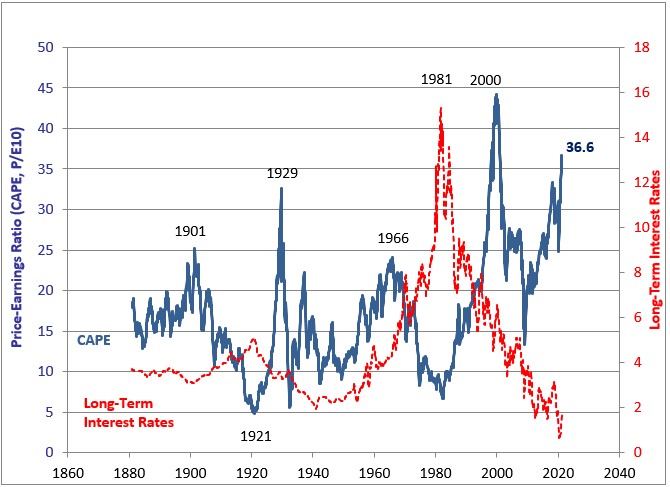

"This time, more than in any previous bubble, investors are relying on accommodative

monetary conditions and zero real rates extrapolated indefinitely. This has in theory

a similar effect to assuming peak economic performance forever: it can be used to

justify much lower yields on all assets and therefore correspondingly higher asset

prices. But neither perfect economic conditions nor perfect financial conditions can

last forever, and there’s the rub."

Jeremy Grantham, article:

Waiting for the Last Dance

The above was posted in an article at

GMO.com,

by the legendary Jeremy Grantham, who delivered the best stock market forecast of our generation.

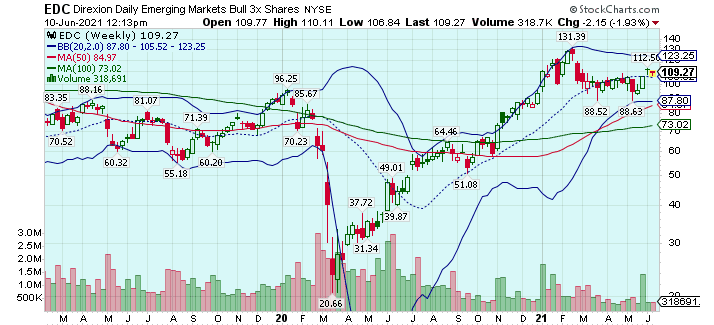

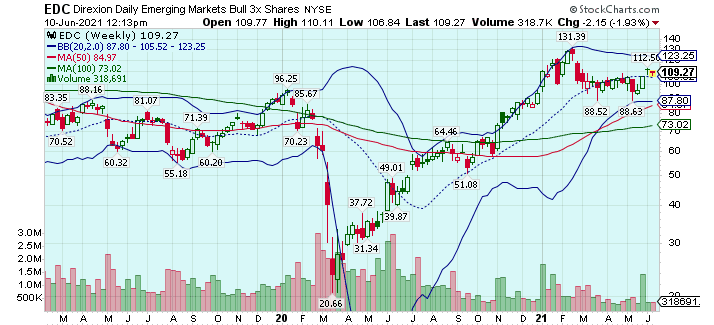

Including also that Emerging Markets would be the play for the next 7 years (posted Aug.2013),

and indeed it was, as the following chart shows. In fact, the ETF "EDC-Direxion Emerging Markets 3X Bull"

went from a low of 20.66 in March 2020, to a high of 131.39 in Feb. 2021. representing 636% increase.

If I would've captured 100 of that move - times 1000 shares = $100,000 in 12 months! Once it got

above 20 it was too rich for my blood!

STOCK MARKET:

The below Monthly chart shows how various Stock Markets have recovered from the PLANDEMIC

(click here to watch).

Only to race skyward due to the FED (federal reserve corp.) pumping in Billions to buy into the markets thereby artificially

pump it up (ie. stimulus) ... only to someday DUMP it (ie. tapering, or bluff thereof).

INFLATION:

Understand, regarding the FED - it's all about managing perceptions.

While the FED balance sheet keeps expanding, inflation is cascading through the PMI, PPI and CPI.

Of course the D.C. bureaucrats are in denial, to avoid public panic, but everyone knows that

inflation is here with more on the way. And with China Joe in charge ... it's a sure thing!

Big Banks know it too! The head of research at Deutsche Bank just put out a paper entitled,

“Inflation: The defining macro story of this decade”, which notes the very

role of government in the economy is undergoing its biggest shift in 40 years manifested

in the fear of inflation and rising levels of government debt that shaped a

generation of policymakers. Replacing it is the perspective that economic policy should

now prioritise broader social goals. (

Download PDF Report)

At its heart the research report debates whether inflation is transitory or the pursuit of

these important social priorities by governments will mean inflation will have longer-term

and far reaching implications for the health of the global economy. Either way, higher

inflation is coming and policymakers are about to face their toughest battle in 40 years.

The official Inflation Rate, as of end of May 2021 is 4.99%. But as for

what is the REAL Inflation Rate, I always turn to

Shadow Stats, and here is what they show (as of 10 June 2021).

"Courtesy of

ShadowStats.com>"

PRECIOUS METALS:

Just look at what has happened to Gold & Silver in the below Monthly Chart!

OUTLINE OF HURDLES:

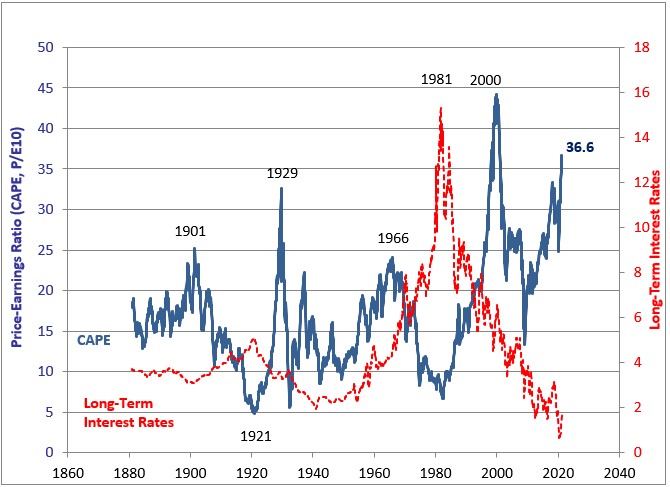

There are many reasons why now looks like a "Last Dance" scenario. To name a few;

- One is the Price/Sales Ratio which is even more pricier than during the

2000 blow-off Top of the 1990's Tech Bubble.

- The most accommodative fiscal and monetary policy in history!

- The stock market has been up 11 of the last 12 years, with 9 years seeing double-digit gains!

- Interest Rates at generational lows for more than a decade!

- Current level of government spending is the most ever in history!

- Inevitable rising inflation and higher interest rates!

- We've NEVER dealt with rates this low before, for so long, combined with

irrational government spending and FED (federal reserve corp.) currency (FRNs) printing.

- FOMC meeting (15-16 June), where they will start discussing when it should

begin tapering its $120 billion per month "QE program", and update its

economic forecasts.

What goes up - must come down. Remember the NADAQ melt-up in 1999 to 2000?

It ended in 80% crash between the March 2000 peak and the bottom in 2001. Markets

peak when there is no one left to buy. And who is left to buy at these astronomically

elevated levels? THAT is what makes 2021 the year that will make all the difference.

The FED cannot buy into the markets, artificially inflating them, forever! In fact,

they are now talking about "tapering" off - meaning, to pull their money out of the

markets. What do you think that will do boys & girls?

IRRATIONAL EXHUBERANCE:

When music stars Snoop Dogg and Gene Simmons

are talking up cryptocurrency "Dog-E-coin" on their Twitter accounts, you know speculating

is starting to get out of control. When teenagers are downloading Robinhood investment platform

and asking Dad what stocks to buy, you know speculation is out of control. None of these

people were interested just a few months ago, and certainly not interested in becoming a

student of the markets. It takes years folks! Wall Street simply wants to capitalize on the

"Greater Fool Theory". As Mr. Grantham stated in the above mentioned article,

"For the first 10 years of this bull market, which is the longest in history,

we lacked such wild speculation. But now we have it, in record amounts.”

The main index of tech stocks, the NASDAQ. is hitting all-time records amid higher highs.

From its bottom just over a year ago, it’s up over 100%. It is in fact the best 1 year

performance in the 50-year history of the index. But the last 2 times in history that we

saw the NASDAQ over 100%, the Melt-Down began soon after.

FED MANIPULATION & MACHINATIONS:

Don't get me wrong, I'm not saying SELL just yet!

As I would probably get sued! But I am saying - CAUTION. Once again, like in

2000 and 2008, I believe we are in the greatest financial mania seen in our lifetimes,

and quite possibly the greatest ever witnessed. This is due to the FED interventions

and manipulations of the currency, the markets, and people's mindset as I mentioned in

my book "NO MORE TAXES" in 1988. If you understand the FED machinations, you know

these cycles are inevitable and built-in to their system. Have your Trailing Stops

in place people - and remember, when it comes to investing - luck has nothing to do with it!

REAL ESTATE MARKET:

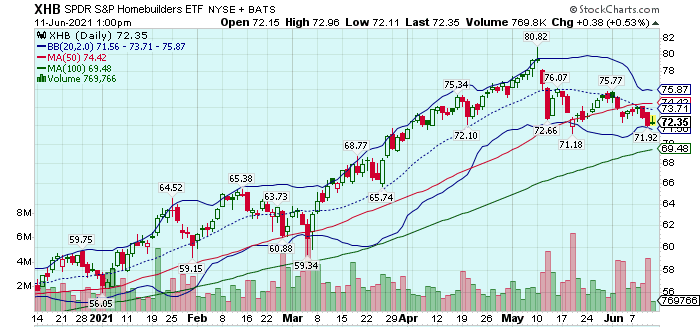

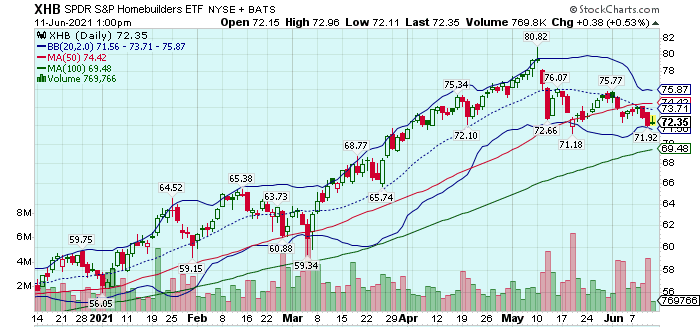

The Real Estate Market is also showing signs of a Top! Note the XHB - Spyder

S&P Homebuilders ETF chart below. It has already crossed below the 18 MA (moving avg.)

and the 50 MA. My TRGT Range is 59.45 to 60.80.

You also have erratic pricing due to the supply side which is causing

havoc for not only Builders, but Appraisers, and Buyers attempting to get mortgages as

the Banks and their Mortgage Brokers also attempt to make any sense of the markets!

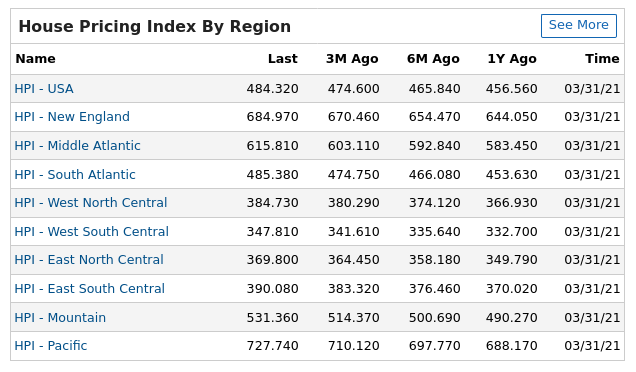

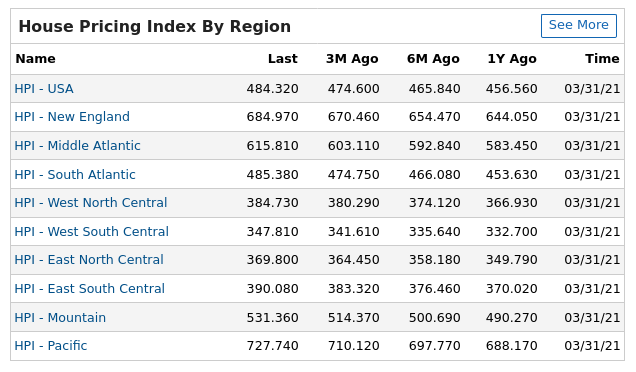

The following Chart shows Home Prices up across the board,

but this is 1st Qtr End as of 31 March 2021. The next one will be out right

after the End of this Month (June 2021).

Many have heard of the price of lumber skyrocketing. Here is a

Monthly Chart for you to feast your eyes upon. Note that lumber futures never traded

above $493.50 before 2018. In May 2021, they reached a high that was more than three

times that level at $1711.20 per 1,000 board feet. Since May 10, the price started

falling as fast as it rallied. Such is the action of Blow-off Tops in markets.

Moreover, Housing Starts and Building Permits are

coming in under Forecast, are more signs of slowing/topping in the Real Estate market.

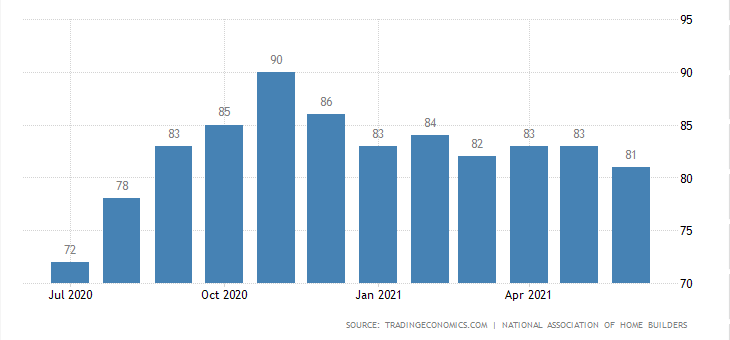

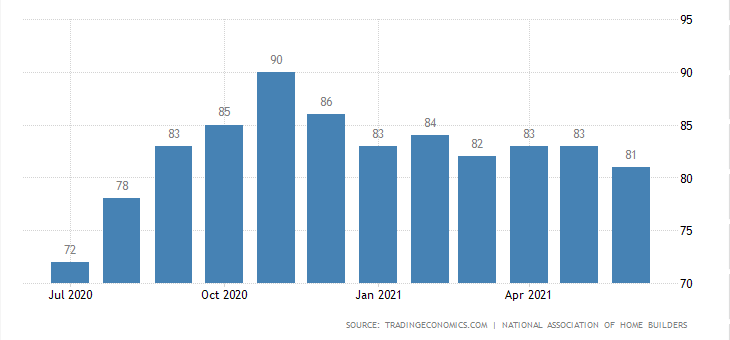

In fact, the NAHB (Nat'l Assoc. of Home Builders) cites rising material prices and

supply chain shortages as causing their Builder Confidence Index to dip to the lowest

level since August 2020 as shown by the following chart.

FORECLOSURES ON THE RISE:

In addition, Foreclosures are still on the rise. A year ago,

March 2020, Bloomberg reported,

“Loan repayment demands are likely to escalate on a systemic level, triggering a domino effect

of borrower defaults that will swiftly and severely impact the broad range of stakeholders in the

entire real estate market, including property and homeowners, landlords, developers, hotel

operators, and their respective tenants and employees.”

One year later, 15 June 2021, RealtyTrac (www.realtytrac.com), the largest online marketplace for

foreclosure and distressed properties, released its May 2021 U.S. Foreclosure Market Report,

which shows there were a total of 10,821 U.S. properties with foreclosure filings —

default notices, scheduled auctions or bank repossessions up 23 percent from a year ago.

Foreclosure starts, which represent the initial notice of default, grew by 36 percent

year-over-year.

BIG OIL:

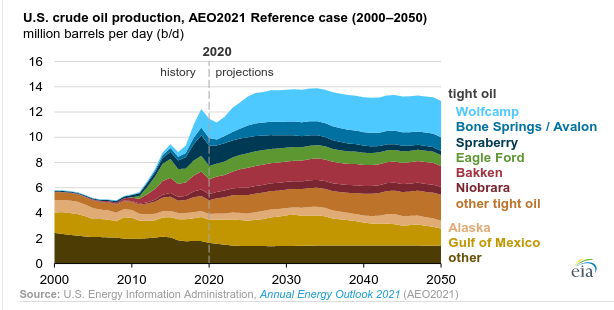

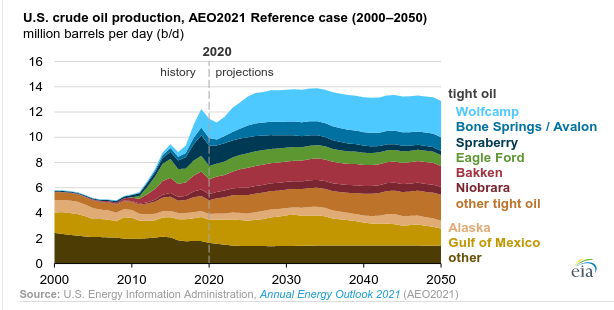

The U.S. Energy Information Administration’s (EIA) Annual Energy

Outlook 2021, which assumes current laws and regulations through 2050, projects domestic

crude oil production to return to 2019 levels by 2023 and then remain near 13 million

to 14 million barrels per day (b/d) through 2050. Problem is, demand is said to grow by

multiples due to Emerging Markets, and therein lies the "squeeeze"! In point of fact,

the Rothschild dynasty (Reuters) pointed out back in Feb. 2021, "Crude prices may return

to levels unseen since 2014 and hit $100 per barrel over the next few years, Bank of

America analysts predict." Not too hard to predict after China Joe cuts off the Big Pipeline

from Canada to the U.S. but supports Putin's pipeline! What do you think that will do to your

pocketbook boys & girls?

SUMMARY:

Make no mistake - inflation is baked into the cake!

My best guess as to when the BIG Downturn in the Stock Market starts? ...

After the Jackson Hole Economic Symposium in late August, the Sep. 21

policy meeting will take place, then is when the fireworks will likely begin.

Sooner if the FED starts tapering in earnest and raising interest rates. In spite of their

transitory rhetoric, its coming just as sure as the flood waters in New Orleans when

everyone was watching the big hurricane coming!

Wake Up and Smell the Stench.

At some point the masses must wake-up and demand, whom the bible refers to as the “Rich Men

of the Earth”, be brought to justice for their crimes against nature and mankind.

The final reckoning is now upon us all. Mankind has to make a choice, as relying on

government always results in failure. Attn: Military - Arrest them for High Treason, Sedition, and

Conspiracy to overthrow the Government of these united States of America during a

fraudulent election. Get rid of those "online" voting machines and DEMAND audits and throwing

out all invalid votes. Secure our elections.

CHANGE IS COMING ... BELIEVE IT ! ! !

BE A PART OF IT - VISIT National Liberty Alliance,

take the Free Constitution Course, the Civics Course, and get involved to take back our

once great Republic.